Trying to buy wine at Airport duty free shops can be somewhat precarious. Quite often, airport duty-free liquor outlets only have a limited range of wines available. Sometimes - lack of retail competition in airports result in overblown margins making the tax savings not particularly worthwhile.

Did you know? - You can in fact buy your wine beforehand and get your tax back at the airport? Under the Australia Government's Tourist Refund Scheme (TRS), travellers can claim a tax refund (subject to conditions) on wine bought in Australia.

The total tax claimable for wine under the TRS scheme is 23.59% of the price of the wine. This includes GST (Goods and Services Tax - 1/11th of the price of the wine), and WET (Wine Equalisation Tax - 14.5% of the price of the wine).

The claim process can be made by the traveller only.

Claims can be made at TRS booths at Australian international airports.

Eligibility Requirements

The date of purchase must be within 60 days before the date of departure.

Your total purchase amount must be more than AUD$300.

You will require a copy of your tax invoice when making the claim, so please let us know beforehand because we do not normally deliver the wine with a tax invoice. If you require a tax invoice from us after you have received the wine, please contact us and we can email / fax a copy to you.

Furthermore, If your purchase amount is AUD$1,000 or more, then it is a requirement that your name and address be on the tax invoice. In this situation, we advise that you provide your exact name as stated on your travel documents (passport, etc) for identification purposes during the claim process.

Only individual persons who are travellers are eligible to make the claim. Eligible persons can be foreign visitors or Australian residents who are travelling abroad. Purchases by companies, business/trust entities etc are not eligible. Airline operating crew members are also not eligible.

You must depart Australia with the wine in full. You will not be eligible for the tax refund if any of the wine is consumed before you leave Australia.

The wine must accompany you on your flight. You cannot make a TRS claim on wine that you ask us to post directly to your overseas address.

You must not bring the wine back into Australia.

Only wine is eligible. Beer or spirits are not eligible.

Practical Considerations

Nowadays, aviation security measures prevent passengers from carrying liquids on board planes, therefore your wine can only be taken on board as checked-in luggage.

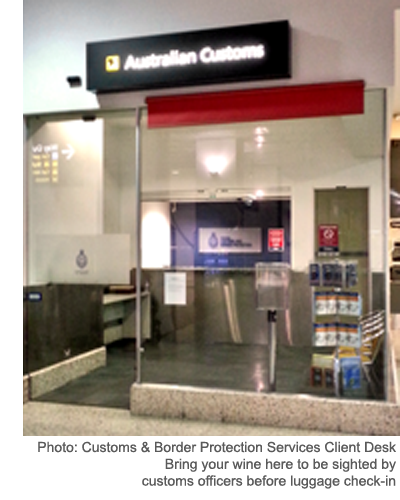

To allow customs officers to sight the wine, you need to bring the wine to Customs and Border Protection Client Services counter before luggage check-in. The customs officers there will stamp your original invoice to indicate the wine as been physically verified.

At the Melbourne International airport, this counter is located at the Arrival Hall level (below the Departure Hall). For a detailed description of where these counters are at various airports, please check out the website of the Australian Customs and Border Protection Service.

The actual claim is to be done at the TRS booth which is located after Customs and Immigration processing. You need to show your original stamped copy of the tax invoice and your travel documents to lodge the claim.

We recommend you allow extra time (say an extra 30 minutes or so) just to claim TRS refunds.

Checked-in luggage may be subject to significant temperature variations throughout the journey. Not only that, the wine bottles have to withstand possibly rough handling from airline staff. As such, we highly recommend that you ask us for polystyrene packaging to put the wine bottles in.

Various countries have different import concessions on the amount of wine you can bring in before having to pay tax/duties. You have to consider this while planning your purchase.

This is particularly important if you are stopping over at other countries before your final destination.

Final Note

The above information is provided as general advice only. We cannot be held responsible if you rely on this information to make your claim.

If you purchase wine from us with the intention to make a TRS claim, please let us know so that we can do our best to make sure you have an easy and successful experience at the airport.

We recommend you refer to TRS information at the Australian customs website for further information.